Part of the problem is the brain drain. The public sector doesn’t pay anywhere near enough to keep the smartest people long term and some of them end up at consultancies on double the salary being charged out at even higher rates.You'd have to think the government would do better having a department set up to specifically bring in consultants for defined periods of time / buying it's own expertise for areas that are potentially going to get a lot of government funding. The mark-ups on labor by consultancies will be eye watering.

-

IMPORTANT // Please look after your loved ones, yourself and be kind to others. If you are feeling that the world is too hard to handle there is always help - I implore you not to hesitate in contacting one of these wonderful organisations Lifeline and Beyond Blue ... and I'm sure reaching out to our PRE community we will find a way to help. T.

Talking Politics

- Thread starter Legends of 2017

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Right which the government then pays triple that to get them back. Madness.Part of the problem is the brain drain. The public sector doesn’t pay anywhere near enough to keep the smartest people long term and some of them end up at consultancies on double the salary being charged out at even higher rates.

Natural outcome when someone else’s money though.

100% true though I’ve had some colleagues who have left oil and gas to work in government and help with energy transition.50% pay cuts easily. They are financially secure though from their 30 year oil and gas careers and packages and lawyer wives/husbands so now doing something more aligned with their values.

Yep.Right which the government then pays triple that to get them back. Madness.

Natural outcome when someone else’s money though.

100% true though I’ve had some colleagues who have left oil and gas to work in government and help with energy transition.50% pay cuts easily. They are financially secure though from their 30 year oil and gas careers and packages and lawyer wives/husbands so now doing something more aligned with their values.

There a number of people in public health like that as well. Doing really complicated and big jobs for much less than the equivalent in private enterprise. They do it because they believe in what they are doing and that it adds value to the community.

I am sure there are other government sectors where it’s the same

David these consulting firms had their genesis as accountants but they are far more than that now. They have consultants across a myriad of disciplines and industries.

Their MO is to employ senior people from those industries who then act as advisers to the sector they left.

Yeah, ex public servants who now cost us multiples of their salary.

Sorry, but I reckon we need a professional public service with expertise in their department employed on a permanent basis. Would be a hell of a lot cheaper.

I have also seen consultants' reports a few times at my workplaces, and I've been in meetings with them. One in particular I remember asking a question where the room just sat stunned at their complete ignorance. I also remember the reports, drivel, cut and pasted from their previous report (which was pointed out by one fellow employee who had worked for one of these mobs).

I have no faith at all in consultants . . . in case you were having trouble working that out

DS

Yeah I have worked it outYeah, ex public servants who now cost us multiples of their salary.

Sorry, but I reckon we need a professional public service with expertise in their department employed on a permanent basis. Would be a hell of a lot cheaper.

I have also seen consultants' reports a few times at my workplaces, and I've been in meetings with them. One in particular I remember asking a question where the room just sat stunned at their complete ignorance. I also remember the reports, drivel, cut and pasted from their previous report (which was pointed out by one fellow employee who had worked for one of these mobs).

I have no faith at all in consultants . . . in case you were having trouble working that out

DS

A professional public service with expertise that negates the need for much consulting work is never going to happen because our public service doesn’t pay enough for that to happen. There are some really great people in the public sector but the depth is shallow and there is also a lot of mediocrity.

Btw I’ve been a consultant but never with one of the big firms, as an independent consultant.

I posted months ago that Phillip Lowe needs to go, and my view on that only grows.

This guy is so out of touch with reality its not funny.

So his claims are:

- Inflation is rampant because wages are high due to a housing supply shortage

Ok - so I can sort of see his point, but nothing is going to change that. So his view is to address rental increases we should increase interest rates. Errmmmm what the actual *smile*!! Those with rents do not have mortgages so this won't change their situation. What will occur is landlords will merely pass these costs down to tenants to offset their mortgages and rents will continue to rise and instead of curbing inflation, will have the opposite impact by driving further inflationery increases.

So that moron said this last week. https://www.abc.net.au/news/2023-05...nterest-rates-will-bring-rents-down/102414220

Ok so, to bring rents down he wants to put renters in such financial stress that they are forced to move out of their homes, and either into shared houses (many already are), or back home with the parents. Did he even think through what the optics of this look like? Anyway, I'll come back to rents and landlords in a 2nd.

So his 2nd point is that there are still many people who have a "war chest" of sort, of savings that they have built up during the Covid years, and he blames those people for also driving inflation, so who are these people and how are they driving inflation. They sure aren't the renters above.

So going back to ABS figures from the 1st quarter of the year, https://www.abs.gov.au/statistics/e...nsumer-price-index-australia/mar-quarter-2023

So to me, the annual figures are largely null and void, due to the extent of the interest rate rises, and if we want to see what impacts the interest rate rises are having, we need to look at the Q1 data in isolation.

This is quite key data as it shows what is driving the inflationery numbers higher. The largest increases during the quarter were actually in healthcare costs and education, so what drive that?

So was education demand driven? Nope. It was driven by annual price increases particularly in tertiary education (start of the school year) and also the removal of a government subsidy scheme.

So heathcare, was this demand driven? Again, no it wasn't. It was driven by annualised heathcare premiums that again go up once a year, and again a change to government subsidies, this time over the PBS.

Most compelling though around what is driving inflation is the below.,

So discretionary spending is only increasing by 0.6% through the quarter, a simple annualisation of that quarterly rate takes you to around 2.4% (well within the range the RBA are looking for) and even then this was driven higher by the increases on uni course fees.

In fact you can see that some areas of goods inflation actually turned negative into a deflationary environment. Clothing and footwear actually declined by 2.6% in the quarter, thats sizeable, they claim it was due to additional discounting, but the question is, why the need to discount unless people are not being able to spend at higher prices? This is exactly what they have been tryying to drive.

Anyway back on those evil rents that are causing inflation wildly out of control. So rents went up 1.6% in the quarter, sure its way ahead of target, but are they really the evil contribution that they are being made out to be? Why not attack the utility companies that are passing on huge increases in commodity prices, despite the fact that most commodity prices have normalised from the crazy high numbers they got to?

All I am seeing is an attempt to further divide the low and middle income classes from the upper class. This is a class divide. There is some analysis that seems to divide the economy into 3 groups.

1 - Around 30% that are in mortgage stress - How does the above do anything other than attempt to push them further into financial stress

2 - Around 30% that are in rental stress - Again the same question can be posed

3 - Around 30% that own their homes and are the ones alleged to have generated large savings through Covid.

So they want to curb spending from those with savings, so how does increasing interest rates achieve this? Simple answer it doesn't. It doesn't address inflation, it doesn't address how to stop inflation, all it promotes is pushing those in the first 2 bands further and further away from financial security.

What is Philip Lowes answer to those in 1 and 2?

1 - Live with more people. One statement that he said was "instead of getting that office, get a lodger instead". Is he for real??

2 - Work more hours or get another job. So again, he is increasing interest rates which will slow consumer spending, so he thinks businesses are going to give people more hours and more jobs, despite the fact that his own press release said they expect these interest rate increases to increase unemployment from 3.7% to 4.5%.

I'm not normally 1 for conspiracy theories, but either he and the entire RBA board are a bunch of out of touch wankers that have no understanding of economics, or there is more at play here. You then think back, and Central banks used to have focus on multiple areas of the economy, economic growth, inflation and employment levels. At some point that was reduced to purely inflation. Someone then made the arbitrary decision that the "correct" inflation level was 2-3%. So who came up with the 1st change and who said the target as pretty much every Westernised countries central banks are working on the same measure?

Economic theory doesn't even back that up. If economic growth and inflation are both increasing at steady rates and unemployment levels are declining, this is actually very positive for the country regardless of what level inflation is at.

Anyway, end of rant but I'm concerned where we as a country are going at this stage, and I can't see anything other than a plummeting economy at the end of this.

Economic growth FYI was 0.2% in Q1 2023. It won't take much to swing this into negative territory and then towards recession like we are seeing in NZ. I have described NZ as the canary in the gold mine as they went earlier and harder than others on interest rate rises. As I expected they are heading for recession (their economy contracted by 0.6% in Q1) and I fear we are on a path to follow them down the same path.

This guy is so out of touch with reality its not funny.

So his claims are:

- Inflation is rampant because wages are high due to a housing supply shortage

Ok - so I can sort of see his point, but nothing is going to change that. So his view is to address rental increases we should increase interest rates. Errmmmm what the actual *smile*!! Those with rents do not have mortgages so this won't change their situation. What will occur is landlords will merely pass these costs down to tenants to offset their mortgages and rents will continue to rise and instead of curbing inflation, will have the opposite impact by driving further inflationery increases.

So that moron said this last week. https://www.abc.net.au/news/2023-05...nterest-rates-will-bring-rents-down/102414220

Ok so, to bring rents down he wants to put renters in such financial stress that they are forced to move out of their homes, and either into shared houses (many already are), or back home with the parents. Did he even think through what the optics of this look like? Anyway, I'll come back to rents and landlords in a 2nd.

So his 2nd point is that there are still many people who have a "war chest" of sort, of savings that they have built up during the Covid years, and he blames those people for also driving inflation, so who are these people and how are they driving inflation. They sure aren't the renters above.

So going back to ABS figures from the 1st quarter of the year, https://www.abs.gov.au/statistics/e...nsumer-price-index-australia/mar-quarter-2023

So to me, the annual figures are largely null and void, due to the extent of the interest rate rises, and if we want to see what impacts the interest rate rises are having, we need to look at the Q1 data in isolation.

This is quite key data as it shows what is driving the inflationery numbers higher. The largest increases during the quarter were actually in healthcare costs and education, so what drive that?

So was education demand driven? Nope. It was driven by annual price increases particularly in tertiary education (start of the school year) and also the removal of a government subsidy scheme.

So heathcare, was this demand driven? Again, no it wasn't. It was driven by annualised heathcare premiums that again go up once a year, and again a change to government subsidies, this time over the PBS.

Most compelling though around what is driving inflation is the below.,

So discretionary spending is only increasing by 0.6% through the quarter, a simple annualisation of that quarterly rate takes you to around 2.4% (well within the range the RBA are looking for) and even then this was driven higher by the increases on uni course fees.

In fact you can see that some areas of goods inflation actually turned negative into a deflationary environment. Clothing and footwear actually declined by 2.6% in the quarter, thats sizeable, they claim it was due to additional discounting, but the question is, why the need to discount unless people are not being able to spend at higher prices? This is exactly what they have been tryying to drive.

Anyway back on those evil rents that are causing inflation wildly out of control. So rents went up 1.6% in the quarter, sure its way ahead of target, but are they really the evil contribution that they are being made out to be? Why not attack the utility companies that are passing on huge increases in commodity prices, despite the fact that most commodity prices have normalised from the crazy high numbers they got to?

All I am seeing is an attempt to further divide the low and middle income classes from the upper class. This is a class divide. There is some analysis that seems to divide the economy into 3 groups.

1 - Around 30% that are in mortgage stress - How does the above do anything other than attempt to push them further into financial stress

2 - Around 30% that are in rental stress - Again the same question can be posed

3 - Around 30% that own their homes and are the ones alleged to have generated large savings through Covid.

So they want to curb spending from those with savings, so how does increasing interest rates achieve this? Simple answer it doesn't. It doesn't address inflation, it doesn't address how to stop inflation, all it promotes is pushing those in the first 2 bands further and further away from financial security.

What is Philip Lowes answer to those in 1 and 2?

1 - Live with more people. One statement that he said was "instead of getting that office, get a lodger instead". Is he for real??

2 - Work more hours or get another job. So again, he is increasing interest rates which will slow consumer spending, so he thinks businesses are going to give people more hours and more jobs, despite the fact that his own press release said they expect these interest rate increases to increase unemployment from 3.7% to 4.5%.

I'm not normally 1 for conspiracy theories, but either he and the entire RBA board are a bunch of out of touch wankers that have no understanding of economics, or there is more at play here. You then think back, and Central banks used to have focus on multiple areas of the economy, economic growth, inflation and employment levels. At some point that was reduced to purely inflation. Someone then made the arbitrary decision that the "correct" inflation level was 2-3%. So who came up with the 1st change and who said the target as pretty much every Westernised countries central banks are working on the same measure?

Economic theory doesn't even back that up. If economic growth and inflation are both increasing at steady rates and unemployment levels are declining, this is actually very positive for the country regardless of what level inflation is at.

Anyway, end of rant but I'm concerned where we as a country are going at this stage, and I can't see anything other than a plummeting economy at the end of this.

Economic growth FYI was 0.2% in Q1 2023. It won't take much to swing this into negative territory and then towards recession like we are seeing in NZ. I have described NZ as the canary in the gold mine as they went earlier and harder than others on interest rate rises. As I expected they are heading for recession (their economy contracted by 0.6% in Q1) and I fear we are on a path to follow them down the same path.

When I was a young student one of my economics lecturers was Dr Neville Norman. He was a young economist then but went on to have a distinguished career here and at Cambridge university.I posted months ago that Phillip Lowe needs to go, and my view on that only grows.

This guy is so out of touch with reality its not funny.

So his claims are:

- Inflation is rampant because wages are high due to a housing supply shortage

Ok - so I can sort of see his point, but nothing is going to change that. So his view is to address rental increases we should increase interest rates. Errmmmm what the actual *smile*!! Those with rents do not have mortgages so this won't change their situation. What will occur is landlords will merely pass these costs down to tenants to offset their mortgages and rents will continue to rise and instead of curbing inflation, will have the opposite impact by driving further inflationery increases.

So that moron said this last week. https://www.abc.net.au/news/2023-05...nterest-rates-will-bring-rents-down/102414220

Ok so, to bring rents down he wants to put renters in such financial stress that they are forced to move out of their homes, and either into shared houses (many already are), or back home with the parents. Did he even think through what the optics of this look like? Anyway, I'll come back to rents and landlords in a 2nd.

So his 2nd point is that there are still many people who have a "war chest" of sort, of savings that they have built up during the Covid years, and he blames those people for also driving inflation, so who are these people and how are they driving inflation. They sure aren't the renters above.

So going back to ABS figures from the 1st quarter of the year, https://www.abs.gov.au/statistics/e...nsumer-price-index-australia/mar-quarter-2023

So to me, the annual figures are largely null and void, due to the extent of the interest rate rises, and if we want to see what impacts the interest rate rises are having, we need to look at the Q1 data in isolation.

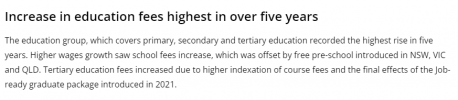

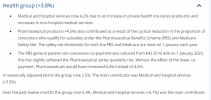

View attachment 19523

This is quite key data as it shows what is driving the inflationery numbers higher. The largest increases during the quarter were actually in healthcare costs and education, so what drive that?

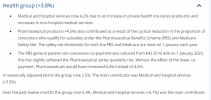

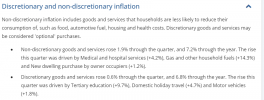

View attachment 19524

So was education demand driven? Nope. It was driven by annual price increases particularly in tertiary education (start of the school year) and also the removal of a government subsidy scheme.

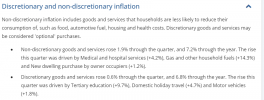

View attachment 19525

So heathcare, was this demand driven? Again, no it wasn't. It was driven by annualised heathcare premiums that again go up once a year, and again a change to government subsidies, this time over the PBS.

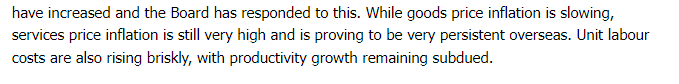

Most compelling though around what is driving inflation is the below.,

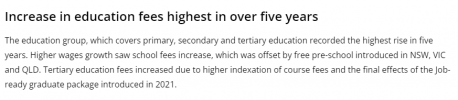

View attachment 19526

So discretionary spending is only increasing by 0.6% through the quarter, a simple annualisation of that quarterly rate takes you to around 2.4% (well within the range the RBA are looking for) and even then this was driven higher by the increases on uni course fees.

In fact you can see that some areas of goods inflation actually turned negative into a deflationary environment. Clothing and footwear actually declined by 2.6% in the quarter, thats sizeable, they claim it was due to additional discounting, but the question is, why the need to discount unless people are not being able to spend at higher prices? This is exactly what they have been tryying to drive.

Anyway back on those evil rents that are causing inflation wildly out of control. So rents went up 1.6% in the quarter, sure its way ahead of target, but are they really the evil contribution that they are being made out to be? Why not attack the utility companies that are passing on huge increases in commodity prices, despite the fact that most commodity prices have normalised from the crazy high numbers they got to?

View attachment 19527

All I am seeing is an attempt to further divide the low and middle income classes from the upper class. This is a class divide. There is some analysis that seems to divide the economy into 3 groups.

1 - Around 30% that are in mortgage stress - How does the above do anything other than attempt to push them further into financial stress

2 - Around 30% that are in rental stress - Again the same question can be posed

3 - Around 30% that own their homes and are the ones alleged to have generated large savings through Covid.

So they want to curb spending from those with savings, so how does increasing interest rates achieve this? Simple answer it doesn't. It doesn't address inflation, it doesn't address how to stop inflation, all it promotes is pushing those in the first 2 bands further and further away from financial security.

What is Philip Lowes answer to those in 1 and 2?

1 - Live with more people. One statement that he said was "instead of getting that office, get a lodger instead". Is he for real??

2 - Work more hours or get another job. So again, he is increasing interest rates which will slow consumer spending, so he thinks businesses are going to give people more hours and more jobs, despite the fact that his own press release said they expect these interest rate increases to increase unemployment from 3.7% to 4.5%.

I'm not normally 1 for conspiracy theories, but either he and the entire RBA board are a bunch of out of touch wankers that have no understanding of economics, or there is more at play here. You then think back, and Central banks used to have focus on multiple areas of the economy, economic growth, inflation and employment levels. At some point that was reduced to purely inflation. Someone then made the arbitrary decision that the "correct" inflation level was 2-3%. So who came up with the 1st change and who said the target as pretty much every Westernised countries central banks are working on the same measure?

Economic theory doesn't even back that up. If economic growth and inflation are both increasing at steady rates and unemployment levels are declining, this is actually very positive for the country regardless of what level inflation is at.

Anyway, end of rant but I'm concerned where we as a country are going at this stage, and I can't see anything other than a plummeting economy at the end of this.

Economic growth FYI was 0.2% in Q1 2023. It won't take much to swing this into negative territory and then towards recession like we are seeing in NZ. I have described NZ as the canary in the gold mine as they went earlier and harder than others on interest rate rises. As I expected they are heading for recession (their economy contracted by 0.6% in Q1) and I fear we are on a path to follow them down the same path.

I heard him the other day and he was scathing of Phillip Lowe and the reserve bank.

His premise is a very simple one and is something a lot of people have been saying and that is that interest rate hikes are the wrong mechanism. They are designed to solve a demand problem when inflation at the moment is not a demand problem. Interest rate hikes are serving no real purpose apart from bankrupting people and ruining their lives.

They are in fact in some ways feeding the very problem they are meant to be solving by increasing the price of goods and services because of the cost of that debt and how it flows through the economy.

Totally agree posh.I posted months ago that Phillip Lowe needs to go, and my view on that only grows.

This guy is so out of touch with reality its not funny.

And the OECD has come out today and pointed to profits driving inflation, Lowe has to be sacked:

I think he will be by default Ian. His tenure finishes in September and he probably won’t be reappointed by the treasurer.And the OECD has come out today and pointed to profits driving inflation, Lowe has to be sacked:

Not sure that will solve the problem though

I heard him the other day and he was scathing of Phillip Lowe and the reserve bank.

His premise is a very simple one and is something a lot of people have been saying and that is that interest rate hikes are the wrong mechanism. They are designed to solve a demand problem when inflation at the moment is not a demand problem. Interest rate hikes are serving no real purpose apart from bankrupting people and ruining their lives.

They are in fact in some ways feeding the very problem they are meant to be solving by increasing the price of goods and services because of the cost of that debt and how it flows through the economy.

When all you have is a hammer, then everything is a nail.

They literally only have one tool and one objective in this space. System was never really set up to handle a supply side driven inflation.

Government is literally doing things too that drive inflation the other way (wage increases, inflationary spending etc.) that are going to do nothing to dampen demand.

Not sure I have the answers - but things that reduce demand other than price (more efficient houses / vehicles (less energy), higher desnity housing (less rent - along with poorer QOL though potentially), less food wastage, recycling/repair etc), zero population growth!) would be more structural fixes but would take forever to play out and some are politically non-starters.

When I was a young student one of my economics lecturers was Dr Neville Norman. He was a young economist then but went on to have a distinguished career here and at Cambridge university.

I heard him the other day and he was scathing of Phillip Lowe and the reserve bank.

His premise is a very simple one and is something a lot of people have been saying and that is that interest rate hikes are the wrong mechanism. They are designed to solve a demand problem when inflation at the moment is not a demand problem. Interest rate hikes are serving no real purpose apart from bankrupting people and ruining their lives.

They are in fact in some ways feeding the very problem they are meant to be solving by increasing the price of goods and services because of the cost of that debt and how it flows through the economy.

This is very true and I mentioned something similar last year that these rate increases will not lead to the desired outcome in the short term without destroying the economy as inflation was being driven by supply shortages. The only way to deal with supply shortages are in 2 ways, increase supply or crush demand by destroying household finances. As opposed to trying to work with the government to do the former, they have chosen the latter. Part of this is due to the reduction in targets that the RBA have, they have 1 and only 1 target. Inflation in the 2-3% range. They have no targets for unemployment, they have no targets for economic growth.

Its highly unlikely that the majority of time, that all 3 measures when using all 3 will remain in the target range, but when only focusing on 1 of those 3 pillars that really drive the economy you can tank 2 of them to ensure 1 remains in that area, and thats where we are headed IMO.

The more statements that they give, the more they don't even align with reality which makes you wonder if something bigger is the real rhetoric here rather than just some dumbarses ruining the economy.

The 2 areas they have blamed in recent weeks for driving inflation are rents - sure they are still growing at 1.6% but why wouldn't they be growing if interest rates rise, as landlords will try and push their input costs back onto tenants. Its almost a self fullfilling prophecy and as you say, as opposed to pooring water on a fire, they are pouring an accelerant on it.

But the other one they have blamed, and it was in their press release from Tuesday.

So they have acknowledged the ABS stats on inflation that goods inflation is slowing (its actually reversing but you know symantics) but they are blaming services. Does that even stack up with the ABS data?

So wage growth (driven by inflation), utilities (supply driven) and other supply costs (supply driven) are driving the cost of services? So yet again, none of this is demand driven so what will increasing mortgage costs do other than push people not to take out these services? So then what of the service companies? Their input costs have increased so we are now aiming to push service companies into bankruptcy. Nice. BTW I did notice in the statement from the RBA, that they stated "service price inflation is still very high and is proving to be very persistent overseas".

Funny that being as their costs are being driven by the same supply driven inflation that is affecting other businesses.

Great postThis is very true and I mentioned something similar last year that these rate increases will not lead to the desired outcome in the short term without destroying the economy as inflation was being driven by supply shortages. The only way to deal with supply shortages are in 2 ways, increase supply or crush demand by destroying household finances. As opposed to trying to work with the government to do the former, they have chosen the latter. Part of this is due to the reduction in targets that the RBA have, they have 1 and only 1 target. Inflation in the 2-3% range. They have no targets for unemployment, they have no targets for economic growth.

Its highly unlikely that the majority of time, that all 3 measures when using all 3 will remain in the target range, but when only focusing on 1 of those 3 pillars that really drive the economy you can tank 2 of them to ensure 1 remains in that area, and thats where we are headed IMO.

The more statements that they give, the more they don't even align with reality which makes you wonder if something bigger is the real rhetoric here rather than just some dumbarses ruining the economy.

The 2 areas they have blamed in recent weeks for driving inflation are rents - sure they are still growing at 1.6% but why wouldn't they be growing if interest rates rise, as landlords will try and push their input costs back onto tenants. Its almost a self fullfilling prophecy and as you say, as opposed to pooring water on a fire, they are pouring an accelerant on it.

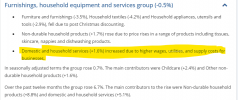

But the other one they have blamed, and it was in their press release from Tuesday.

View attachment 19528

So they have acknowledged the ABS stats on inflation that goods inflation is slowing (its actually reversing but you know symantics) but they are blaming services. Does that even stack up with the ABS data?

View attachment 19529

So wage growth (driven by inflation), utilities (supply driven) and other supply costs (supply driven) are driving the cost of services? So yet again, none of this is demand driven so what will increasing mortgage costs do other than push people not to take out these services? So then what of the service companies? Their input costs have increased so we are now aiming to push service companies into bankruptcy. Nice. BTW I did notice in the statement from the RBA, that they stated "service price inflation is still very high and is proving to be very persistent overseas".

Funny that being as their costs are being driven by the same supply driven inflation that is affecting other businesses.

When all you have is a hammer, then everything is a nail.

They literally only have one tool and one objective in this space. System was never really set up to handle a supply side driven inflation.

Government is literally doing things too that drive inflation the other way (wage increases, inflationary spending etc.) that are going to do nothing to dampen demand.

Not sure I have the answers - but things that reduce demand other than price (more efficient houses / vehicles (less energy), higher desnity housing (less rent - along with poorer QOL though potentially), less food wastage, recycling/repair etc), zero population growth!) would be more structural fixes but would take forever to play out and some are politically non-starters.

The simple way to fix this is to move to a model whereby there are more tools available, or at least more measures that are taken to review an economy.

It seems the only thought pattern is "inflation bad" and everything else must suffer to curb that horrible inflation, and in some ways that is right. Spiralling and uncontrolled inflation has resulted in significant economic collapses both recently and historiocally.

This is a decent article in the Guardian, key points are towards the end.

The RBA review ignores the global failure of inflation management to prevent financial chaos | John Quiggin

The RBA review ignores the global failure of inflation management to prevent financial chaos

We are stubbornly trying to keep to a 2-3% target at all costs, rather than allowing some of this to filter through the economy. A higher target inflation that still allows the economy to grow and maintain low levels of unemployment is still a strong economy as long as all 3 measures of the economy remain under control. At the moment, inflation is out of control, so their attempt to fix that is to destroy economic growth and drive unemployment levels up.

Static targets like this will always lead to boom and bust cycles, if they want to soften boom and bust cycles the best way is with progressive and variable targets around those 3 pillars of economic health, economic growth, inflation and unemployment levels.

The RBA aren't totally at fault here, the government takes a lot of the blame too, as essentially the RBA are given 1 target. Think of it like a Sales Manager running a business, if their only target is to target Sales growth, then they will reduce prices and drive volume, but that can only lead to margin decline and ultimately has killed many companies throughout history. You cannot run a business or an economy with only 1 measure that you are targeted to control, but the RBA review says "nothing to see here, everything is good", despite the fact that only 2 months in the last 3 years has inflation been within that target range.

I’ll use that one if you don’t mindWhen all you have is a hammer, then everything is a nail.

The aim to drive unemployment up and prevent real wages from rising or even staying at the same level is partially to attempt to combat inflation but it is also ideological. Unemployment is too low, if unemployment is too low then workers have too much bargaining power and they just oppose that on principle.

Profit share of income is up, but do we ever hear the Reserve Bank, the government, economists or anyone else say that profits need to reduce in real terms? Never.

DS

Profit share of income is up, but do we ever hear the Reserve Bank, the government, economists or anyone else say that profits need to reduce in real terms? Never.

DS

but then sometimes you are better no hammering at all.When all you have is a hammer, then everything is a nail.

as someone who hasnt done economics since high school, i wont pretend to be an expert, but it really looks like the RBA is seeing a problem- inflation- and using its only fix- interest rates- without any real consideration of the true cause of the problem, or the other effects of their fix.

The real causes are 2 for me.but then sometimes you are better no hammering at all.

as someone who hasnt done economics since high school, i wont pretend to be an expert, but it really looks like the RBA is seeing a problem- inflation- and using its only fix- interest rates- without any real consideration of the true cause of the problem, or the other effects of their fix.

1 is population growth is outstripping housing growth (supply). Cost of rent/mortgage etc. is a big driver of indlation. Population growth currently being driven by immigration. So you could ban immigration and that would immediately ease demand for housing and the inflow of capital (as we generally only allow high skill immigrants). You would see big impacts on the labor market and the stock market. or on the supply side you unrestrict supply.

2 is the cost of energy. This is driven by the Russian-Ukraine war. It will be also driven by the massive costs involved in switching to renewables. Also our explosion in natural gas prices means for east coast australia energy cost is high (and natural gas makes electricity too). So government could massively intervene in gas market in short term, or look to make us more efficient and use less energy in the long term. Energy feeds into the cost of everything. High prices do drive efficiency / or demand destruction. I don't think society really gets the costs involved in the energy transition and at least through the transition energy is going to cost a fair bit and its going to become pretty obvious - personally unless lots of people sacrifice their quality of life in some way it won't happen - it's going to cost a lot to do it (but beats ending life on earth). Some things - like electrifying and using reverse cycle A/C to heat housing / putting in insulation etc. will actually be cheaper than what we do now - but doesn't apply to everything.

3. Real wage growth is anaemic and not the cause

To the extent interest rates cause people to share living arrangements and use less energy and just buy less stuff in general then I guess you get an outcome. People are going to demand more wages because their costs are higher (which then translates into higher costs for everthing else as companies pass the higher labor costs on to consumers). It's hard to see how there isn't some impact to property prices as people are forced to sell - but if the capital coming into the country with immigration can afford to buy these properties....then maybe not.

The RBA is charged with maintaining inflation and only have one tool. The government has the other tools but won't use them and will blame the RBA. Hyper-inflation leads to misery so certainly don't want to go down that path. (check out argentina). By its very nature to stop inflation you cause some pain - its where you direct it.

but then sometimes you are better no hammering at all.

as someone who hasnt done economics since high school, i wont pretend to be an expert, but it really looks like the RBA is seeing a problem- inflation- and using its only fix- interest rates- without any real consideration of the true cause of the problem, or the other effects of their fix.

Its not necessarily purely the RBA's fault, but the treasurer is now asleep at the wheel.

The treasurer provides a target to the RBA, the only target they provide is inflation in the region of 2-3%, so they are doing that. Philip Lowe is a horrible wordsmith and suffers from foot in mouth disease a lot of the time (which is why he needs to go), but the overall issue should be, why is Chambers allowing this to happen. He can change targets with the RBA, but the governments own review into the RBA says "everything is awesome" and we don't need to change a thing, even thougb our economy was looking strong, albeit with some temporary supply side driven inflation.

Economy was growing, unemployment was low, everything was looking rosy, then the interest rates started flying up.

This is our economic growth by quarter, obviously the Covid years show significant swings due to lockdowns etc. The DEc21 quarter was 3.9% which was the biggest growth, but mainly offsetting the prior quatter decline, but if we look at consistent quarters from then growth was nice and in line with what you expect the government to want economic growth (again its that 2-4% range annually) so quarterly economic growth of 0.6% in the March 22 quarter, followed by 0.8% in the June quarter and right in that sweet spot for economic growth. Then the *smile* hit the fan with inflation, and rates started risaing, decreasing the Sep quarter to 0.6% and the December quarter to 0.6% also, so not terminal.

This was all ok at that point IMO, rates had to rise from their lows, but they needed to be controlled. The cash rate had risen to 3.1% but economic growth was resiliant.

Then they continued to increase rates and look at Q1 2023, a decline to 0.2%, not even an annualised growth rate of 1%. Weak, weak, weak, yet they have continued to double down and increase rates even after such a poor quarter of economic growth.

My view is, we have hit the tipping point, and have accelerated over the edge of it and our economic growth is plummeting. Every day we read about more businesses in financial trouble and I fear we have pushed too hard at the end. Personally I didn't think the 1st quarter inflation data warranted more rate increases. Goods inflation heading into a deflationary position, inflation being driven by statutory increases in things like cigarettes, tertiary education, healthcare etc and I fully expect the June quarter to show a negative growth in the economy.

Had the bank had more than 1 target (inflation), I would like to think that the last 2 rate increases would have been paused. Sure inflation needs to come down, but not at the expense of the overall economy, yet it looks like the change will swing it too far.

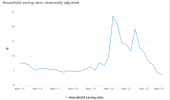

There has been much talk about household savings through Covid, and thats true and backed up with stats but look how far the level of household saving has fallen since rates have increased, and this will continue to fall further in the June quarter with continued increases in interest rates. The rate at the end of Q1 was the lowest rate in household saving since 2008.

So therefore what are people spending on? Discretionary spending peaked in the December 21 quarter as we exited much of the lockdowns that we were under from Covid, spending continued at a fairly high rate into the 1st half of 2022 as those savings shown above through Covid were spent on discretionary items as we came out of the Covid years, but again since June 22 see how discretionary spending has dived (where in Q1 2023 discretionary spending was negative) and in the same 9 month period see how non discretionary spending has spiked upwards.

All of this backs up what we all see, that the economy is weak, that inflation is driven by supply side issues, and between that and increasing interest rates it is taking money away from households either reducing their ability to save or spend on discretionary items, yet we have continued to increase interest rates in both April and May.

From an economic point of view, those rate rises don't make sense. The rate rises up until March had done their job, possibly too much as economic growth fell below 1% annualised (on an annualised basis just from Q1, you don't see those stats as they use rolling 12 months but with the changes in prices / rates we have seen over the last 12 months, annualisation of Q1 is probably a more accurate representation of the economy.

All the data points away from the "soft landing" that Philip Lowe has spoken about and to 1 that will be hard, very hard even. We have pushed way too hard for too long on rates, and unfortunately I can't see a good finish for the rest of 2023, but this could have been avoided, had the government provided the RBA with various measures to measure economic strength rather than just focus on inflation.