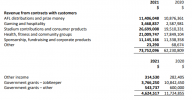

Richmond Football Club has reported an operating profit of $2,486,626 for the financial year ended 31 October 2021. The Club generated total income of $78,376,613

https://www.richmondfc.com.au/news/1034431/richmond-2021-financial-result

2021 Richmond Concise Financial Result

https://www.richmondfc.com.au/news/1034431/richmond-2021-financial-result

2021 Richmond Concise Financial Result